We Are Fee Based Benefits And Pension Consultants

transparency Creates Trust

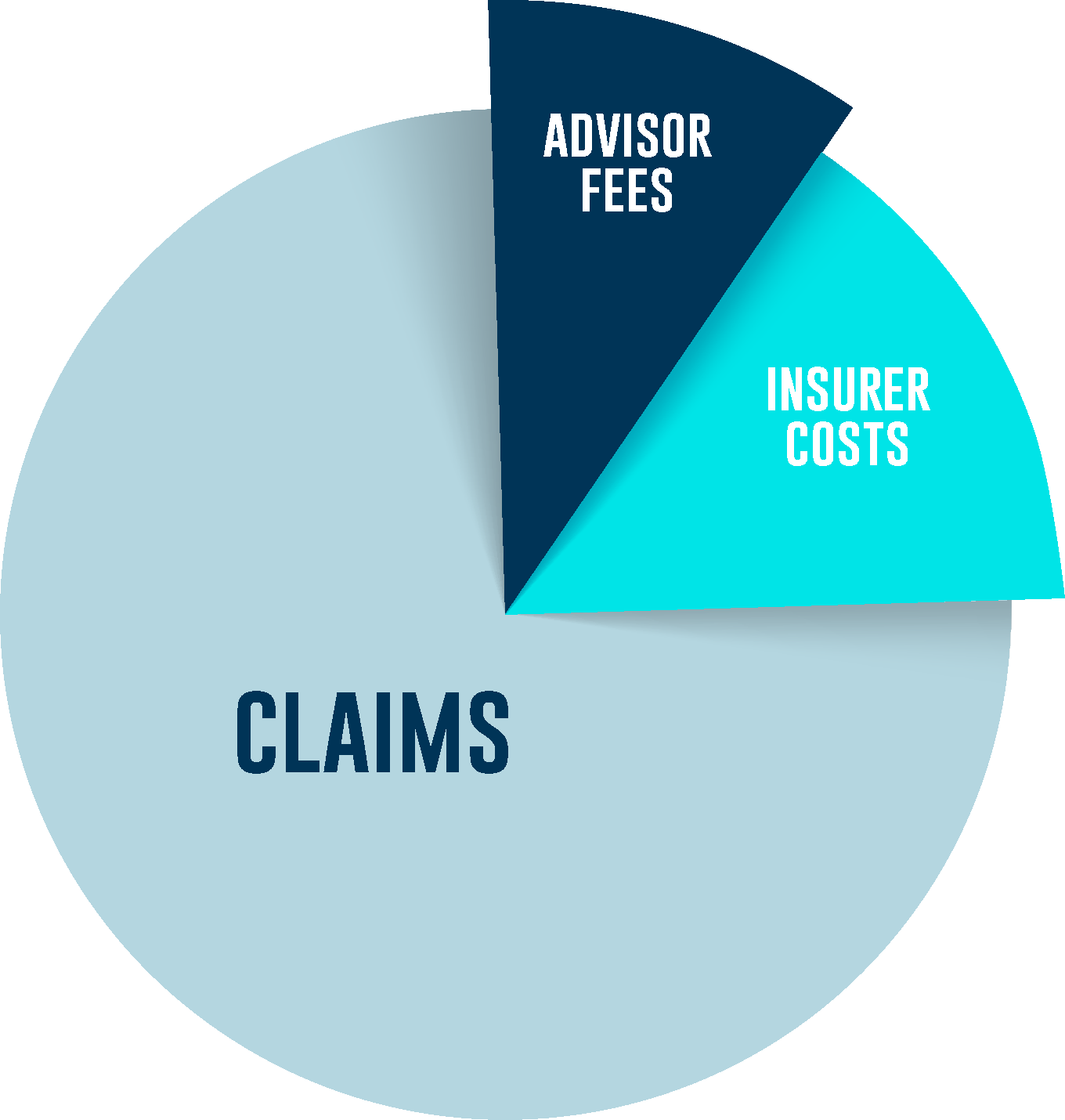

Making sense of the financials of your employee benefits can be a frustrating exercise. We want to make that process simpler and more straight-forward and we do this by having a separate conversation about what percentage of your premium are redirected to paying for your advice.

Most companies pay for their advice with what are called embedded fees. That means a portion of your premiums or savings plan contributions end up being commission. If you are sharing costs or matching contributions with your staff, that means they are also helping pay for this service.

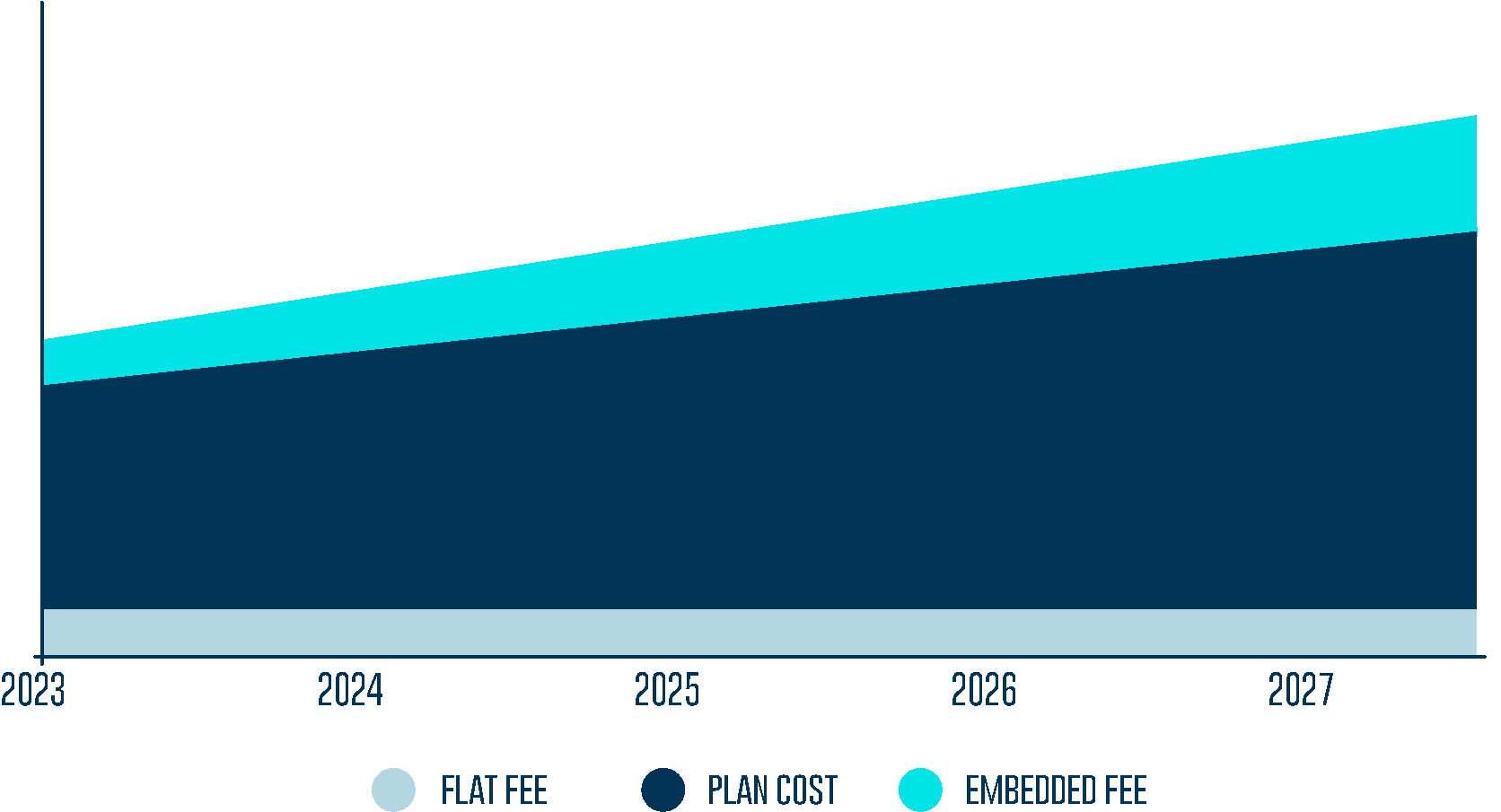

Typically the result is that when your plan costs go up, either from higher claims or improved coverage, the real dollar amount you are paying in fees goes up as well.

WHY WE DO IT THIS WAY

We believe there is an inherent moral dilemma from profiting off of clients rising costs. For this reason we view embedded fees, when not transparent as ethically indefensible. At Paramount, we succeed, when you succeed. Not regardless of whether or not your business is a success. We do this by separating our fees from the cost of your programs entirely.

The difference between commission on premium or claims and a flat fee is that one compounds your costs when claims and premium go up, and the other is proportional to the amount of real work being done on your behalf. We want your relationship with our firm to grow over time, because we’ve delivered on fair value. Not because the cost of your program increased.

With respect to embedded fees on retirement programs. Paying your advisor a percentage of the assets under management erodes the investment returns for your members and puts undue pressure on markets to perform, which is something your advisor has no control over.

Transparency of fees is the root of trust that we are acting in your best interests. Why should your company and staff have to pay more for advice, simply because your claims costs went up or you wanted to improve your coverage? We fundamentally disagree with this practice.

Our Core Services

Employee Benefits

Having to constantly index the administrative fees on your benefit plan is an additional, compounding layer of cost pressure that we can remove for you. Our model removes incentive for rising plan costs for the consultant. This solution creates great plan cost stability and transparency.

Pensions & Group Retirement Savings Plans

Embedded commissions are paid out of the deposits intended to fund your savers retirements. Consultants have no impact on the performance of the markets and do not manage the underlying funds in your plan. Our position is that advisors should be paid only for the work they do. They are not entitled to a fixed portion of your retirement plan funding.

The Insight Plan

Comprehensive Benefits Without Massive Fees

Smaller employers looking to offer competitive benefits typically pay the highest fees. We have solved this problem.

The Insight plan is our solution to this challenge. A tailored program with a custom designed support model built to allow small employers the opportunity to offer competitive benefits and enjoy the cost structure typically reserved for large employer plans.

If rate volatility and fees are crushing your small employee program, ask us about Insight today.

Other Specialties

Health Spending Accounts / Wellness

Health Spending Accounts are a popular option for improving the flexibility of existing benefits or as a fixed cost alternative. Wellness accounts offer you the ability to cover taxable items as part of your program.

.

Employee Education

We offer a variety of options for employee education. Ask us about booking a webinar or lunch and learn!

Expatriate & International Solutions

If you are an employer with operations south of the border or abroad we have solutions for you.

Bitcoin Savings Plan

Whether you want to differentiate your benefits package or augment your group savings plan the BSP represents an interesting.

#202A – 269 Bernard Ave

Kelowna, BC V1Y 6N2

236 | 475 | 9410

CONTACT US AND START YOUR FREE AUDIT TODAY

CONTACT US AND START YOUR FREE AUDIT TODAY

"(Required)" indicates required fields